Ready for potentially millions in fines?

How to make sure you‘re not exposed to the new wage theft penalties.

From 1 January 2025, Australia’s rules for preventing wage theft have changed – and they’re not pretty. With up to 10 years’ imprisonment and/or a whopping $1.5 million (approx.) for individuals, or almost 8 million in possible penalties for body corporates on the line, the Labor government is sending a clear message to employers. For directors, executives and senior managers, this symbolic red flag is likely intended to motivate proactive action to prevent systematic payroll errors and intentional underpayments.

Understanding wage theft

It’s important to note that the changes don’t include honest mistakes, however “intentional” is a broad statement and pleading ignorance is unlikely to be solid defence at an executive level with strong budget control and access to plentiful resources.

The Fair Work Ombudsman has stated that “An employer may commit a criminal offence where they:

– Were required to pay an amount:

– to an employee such as wages or paid leave entitlements, or

– on behalf of the employee, or for their benefit, such as superannuation or a salary sacrifice arrangement.

– Have intentionally done something that intentionally results in those amounts not being paid on or before the day they were due.”

Prevention and rethinking your workplace

As a result to the changes to legislation, senior leaders and executive leadership may need to reconsider how they manage their remuneration strategy, headcount and processes – which itself may pose some challenges, as remuneration is a specialist topic and traditionally a difficult area to build or deep dive into.

The new penalties cannot be applied to previous intentional underpayments. This means employers have a chance to minimise their risk by focusing on their business approach from 2025 onwards. In the case of an intentional underpayment, there is also opportunity to cooperate with the Fair Work Ombudsman to stop them referring agreed matters for criminal prosecution, and a different path for small businesses in wage compliance.

Consider:

– Are you clear on the roles in your organisation that are covered by an industrial instrument?

– Are you checking and applying any award rate increases on a regular basis?

– Are your managers clear on when overtime applies?

– Are you obligated under an award or enterprise agreement to conduct annual audits on annualised salaries? Do you have enough FTE in your payroll team to conduct regular audits?

– What allowances are your employees entitled to (e.g. car or travel allowances, tool allowances, leave loading)? Are these set up to succeed in your payroll and timesheet systems? Are the applied automatically or manually, and if manually, who directs who to apply them?

– Is your payroll system working well? How does it interact with any other systems? E.g. if you have automations or exports running regularly from your timesheet or HRIS system to payroll, how are the numbers being rounded?

– Do you need to start keeping records of time worked, to ensure you can provide evidence or conduct an audit in the event of a possible underpayment?

– How is leave processed in your organisation? Are you clear on how leave and RDOs interact with public holidays?

– Is there any other legislation that impacts how you pay your people? E.g. APRA regulations may impact how the financial industry pays bonuses or dictate links between poor conduct/performance outcomes and remuneration.

If you need advice to ensure you are paying your people properly, assistance in managing your HR risks, help to audit your compliance with the new wage theft legislation or training for managers on overtime and awards, please contact us at Azuhr.com or on 1300 909 819.

Peitra Moffat

Managing Director

Azuhr

Gabrielle Puzey

HR Consultant

Azuhr

Related News

-

28.01.2026

What is your culture telling you?

-

10.10.2025

Retail and hospitality in focus: AHRC compliance reviews

-

15.08.2025

Resolving Conflict Before It Escalates – The Power of Early Intervention

-

12.08.2025

When Ignorance Isn’t Bliss: The Mad Mex Case That Puts Franchisees on Notice

-

10.06.2025

Incivility: The underestimated risk in your workplace

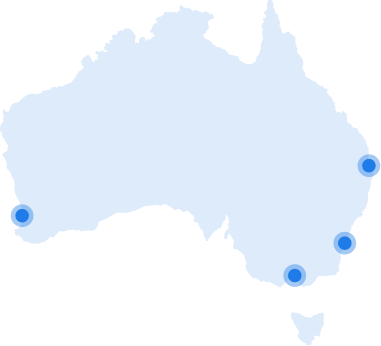

Our Sydney Office

- Phone: 1300 909 819

- Address: Level 5, 1 Bligh Street, Sydney, NSW 2000

Our Melbourne Office

- Phone: 1300 909 819

- Address: Level 9, 140 William Street, Melbourne, VIC 3000

Our Perth Office

- Phone: 1300 909 819

- Address: Level 29, 108 St Georges Terrace Perth WA 6000

Our Brisbane Office

- Phone: 1300 909 819

- Address: Level 7, 300 Queen Street, Brisbane, QLD 4000

OUR OFFICES

Where To Find Us

We’re here to help you navigate the human resources and employee relations landscape, with offices and consultants across Australia.

PREV

ARTICLE

PREV

ARTICLE